Many factors, including laws, regulations, politics, and other financial considerations we may not be aware of, significantly influence the affordability and reliability of the electricity our local utilities provide. However, knowing a little more about how these factors affect the cost of lighting, heating, and cooling our homes or make it more or less likely we suffer blackouts can help us see whether political or regulatory actors are helping or hurting.

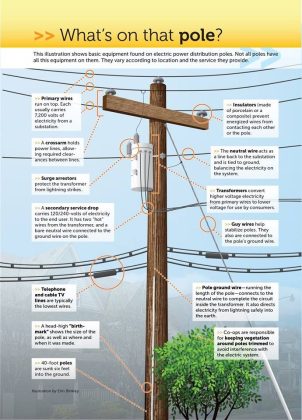

Like many large projects – from highways and bridges to skyscrapers and stadiums – the cost to finance construction is enormous. Instead of paying for these projects in cash, both states and businesses borrow large sums of money, which they guarantee will be paid back with interest. Utilities do the same to maintain, build, and expand the network of poles, wires, and transformers that ensure that the lights turn on when you flip the switch.

When borrowing money, there is a unique factor for regulated utilities that makes the cost of debt – the interest rate – even more important. Regulated utilities need approval from regulators to recover their investment in projects that keep the lights on. This means they have to pay using both equity (cash) and debt (loans) in return for ensuring that there is safe, adequate, and reliable electric service.

Let’s put that in personal finance terms. If you have to make a big purchase like a car, you want to have the lowest possible interest rate, right? Of course. And just like us, the better our credit, the better we appear to lenders, and the lower our interest rates are. The same principles apply to utilities.

When the legal and political factors that influence the regulatory oversight of utilities in a state are more favorable and predictable, utilities are considered a good investment by creditors. Well-managed utilities have strong credit ratings, which correspondingly leads to a better ability to borrow money. This is similar to why we get credit card limit increases when we spend responsibly and pay on time. For utilities, this lowers their interest rate and our electric rates, too.

On the flip side, if the regulatory environment is volatile and unpredictable, a utility’s credit rating could be downgraded, which increases its cost to borrow funds by increasing interest rates, making investments more expensive for consumers. Without predictable and favorable conditions, utilities are less able to invest. Additionally, borrowing costs could be so high that they slow down utilities’ investments in the grid, reducing reliability and preventing new resources from entering the market.

While the funding, financing, and borrowing methods are indeed more complex than we have illustrated here, the fundamental idea remains the same. A strong and predictable legal, regulatory, and political environment is not just important to utilities—it’s also something we, as consumers, can influence. By understanding and advocating for a responsible, fair, and honest regulatory environment that prioritizes affordable, reliable, and environmentally responsible energy, we can get it.

As politically driven actions like favoring specific energy sources or mandating the elimination of others continue to crash into the math and physics required to reliably and safely run a grid 24/7, we run a greater risk of blackouts and brownouts. Right now, parts of the U.S. and Canada are at risk of summer blackouts, and with all the changes being made, those risks could make their way into the winter, too.

As politically driven actions like favoring specific energy sources or mandating the elimination of others continue to crash into the math and physics required to reliably and safely run a grid 24/7, we run a greater risk of blackouts and brownouts. Right now, parts of the U.S. and Canada are at risk of summer blackouts, and with all the changes being made, those risks could make their way into the winter, too.

We can avoid that if we return to responsible policies that place reliable, affordable energy where it should be – as part of the basic foundation of our economy, national security, and way of life.

Sample Utility Bill